Rial-ity check

Reconstructing Iran's chaotic exchange rate system

They are sending in Jared Kushner which means the situation in Iran is getting worse.

The WSJ wrote an excellent piece on the economic crisis in Iran, which led me to start digging into the collapse of the country's financial conditions. One thing that caught my attention was the structure of Iran’s exchange rates. I’ve been looking at currency markets for 24 years (shout-out to Dr. Toumanoff, the econometrics professor who encouraged me to study the reunification of the German mark), and frankly I have never encountered a more convoluted exchange rate system in modern economics.

Iran’s foreign exchange system has been subject to decades of sanctions, capital controls, and state intervention, so no wonder it’s fragmented. For years, multi-tiered exchange rates enabled corruption, split the economy into haves (those with access to cheap dollars) and have-nots (those without), and hopelessly complicated policy interventions because the government had to manage multiple rates instead of one.

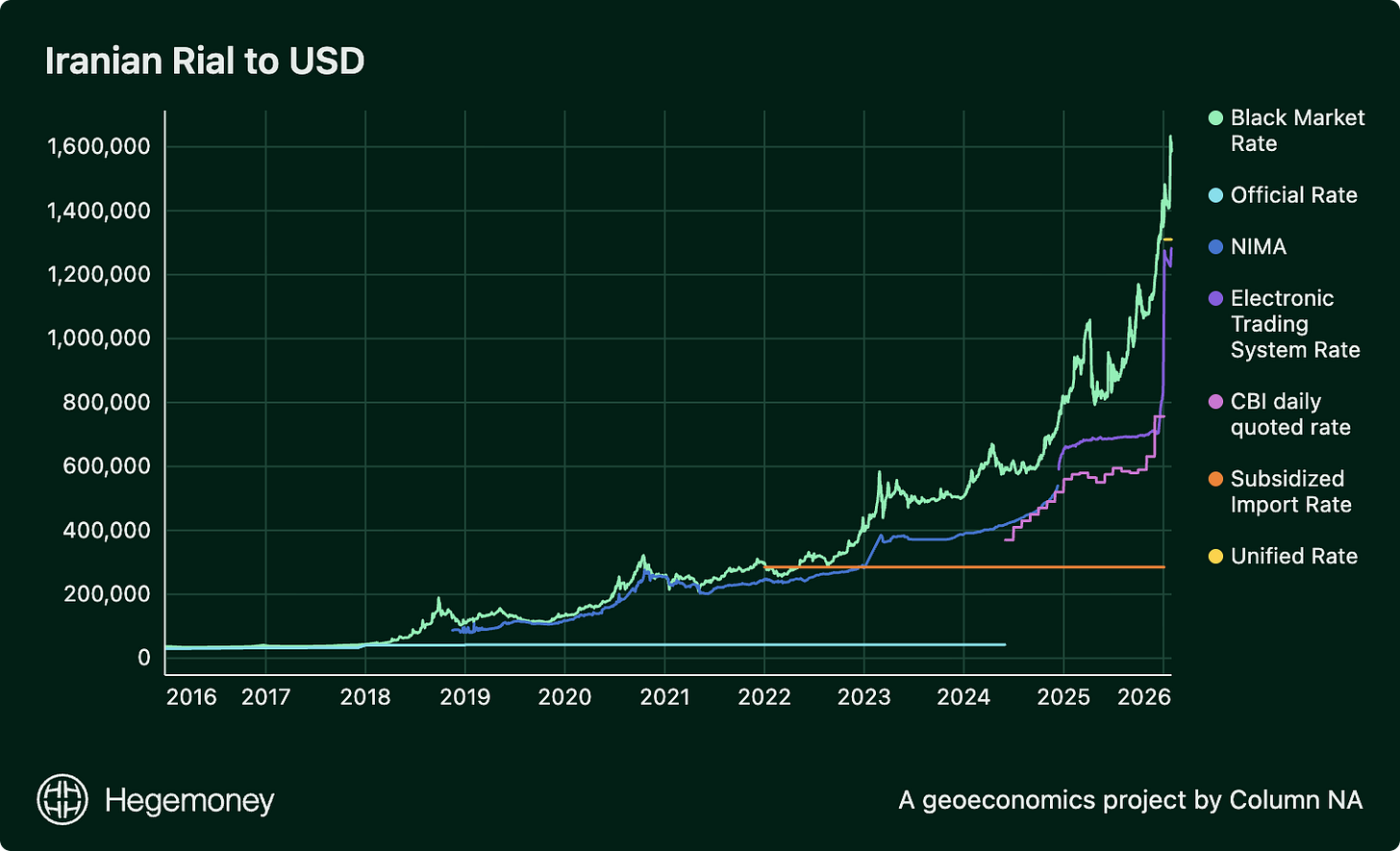

By 2022, Iran appears to have had at least five simultaneous exchange rates. I believe this multiplicity of rates contributed directly to the January 2026 protests and currency collapse — to test this hypothesis, I reconstructed the exchange rate system using Iranian market data, international sources, and press reports.

A few framing thoughts before we get into the data:

Iran’s data is lousy: Iran doesn’t publish reliable exchange rate data. I’ve done my best to cobble together fragmented, contradictory, poorly-labeled information, but significant gaps — particularly 2019–2023 — limit conclusive analysis. I’ll note the data quality for each rate. Where reliable daily observations were unavailable I’ve smoothed the series (i.e. did it for the plot).

Multiple exchange rates breed corruption: Multiple exchange rates give political elites access to affordable hard currency, the ability to extract favors in return for that access, and the enormous temptation to exploit the arbitrage between an “official” or subsidized rate and the black market rate. An Iranian tea company, for example, obtained $3.37 billion in subsidized currency for imports but sold $1.4 billion worth of that currency on the open market at a significant profit — resulting in one of the largest embezzlement cases in the history of the Islamic Republic.

Sanctions create haves and have-nots: The goal of sanctions is to put enough pressure on an economy to force a change in behavior. In the process, sanctions exacerbate inequality, often enriching the elite while squeezing the middle class. Goods, services, and dollars become inaccessible to “everyday Iranians” (to borrow a much-abused political term), and eventually people take to the streets.

It’s the black market versus the central bank: Among the seven distinct rates I found for Iran, six were in some way managed by the Central Bank of Iran (CBI). In addition to fostering corruption, multiple exchange rates just rarely work and are usually a sign that something is broken. If your country has a black market exchange rate, you might want to consult a doctor (of economics). My editor hates these jokes. Anyway, although in some instances multiple exchange rates have been used to manage capital controls, generally they are a crisis response and a bandage for dollar shortages — they’re meant to open a release valve and buy the government time, but they never fix the underlying problem.

Iran’s attempt to unify the exchange rates did more harm than good: The government’s decision to unify the exchange rates (more below) meant that the government was no longer subsidizing essential imports. The elimination of the heavily subsidized import rate (again, more below) removed an implicit subsidy of roughly 75–80% on many essential goods, instantly spiking prices. This amplified the inflationary shock and ignited widespread protests. Peak protests and violent government repression happened right after this announcement (Jan 8–10).

Now behold, chaos:

Here’s what we’re looking at:

Black market rate (green line)

This is the street price at which individuals and most businesses actually transact. Government rates are somewhat irrelevant for daily life because they’re artificially low, heavily restricted, and don’t reflect true dollar scarcity. The black market rate diverging from official rates is a fundamental vulnerability. Every percentage point of divergence creates “arbitrage opportunities” (e.g. corruption).

Iran’s currency crisis unfolded in stages. The black market rate held steady at 37,000 rials per dollar through 2017, but President Trump’s exit from the nuclear deal (JCPOA) in 2018 sent the rate soaring to 190,000. After ranging between 125,000–300,000 during COVID, and climbing to about 600,000 by 2024, the rial crossed 1 million for the first time in March 2025. Then the wheels came off: in the past seven months, the rate has exploded from 800,000 to over 1,600,000 rials per dollar, halving the currency’s value.

Data quality: Daily from Bonbast.com, a widely-used parallel market aggregator and the most consistent public source available. High confidence for directional trends; medium confidence for precise daily figures.

Official rate (aqua line) and CBI Reference/daily quoted rate (pink line)

Iran had a managed float (market-driven rates with periodic government intervention) for many years that stayed pretty close to the black market rate. In early 2018, facing currency panic after the JCPOA collapsed, the Iranian government tried to enforce a pegged rate of 42,000 rials per dollar. They made other rates illegal! Which of course failed, forcing the CBI to introduce additional subsidized rates. Without massive dollar reserves, which Iran didn’t have, you can’t defend a peg at 42,000 when the black market is 600 percent higher.

Parliament finally voted to phase out their pegged rate in 2022. The CBI didn’t formally abandon it until mid-2024. This official rate was then replaced with the CBI reference rate which the CBI called a “weighted average” rate, starting around 370,000 and gradually climbing to over 600,000.

Data quality: Monthly from IMF/World Bank (high confidence on the numbers themselves). The timing of the phase-out is less clear. For the CBI reference rate, we used data from CEIC and the CBI website. High confidence on the numbers; low confidence on what the “weighted average” actually includes as I did not find the Central Bank of Iran’s methodology all that transparent.

Subsidized import rate (orange line)

When the Iranian Parliament killed the 42,000 peg, the government still wanted to subsidize essential imports (food, medicine, agricultural inputs). So they created a special rate starting at 285,000 rials in early 2022. This import rate stayed frozen even as other rates climbed, which proved to be a prohibitively expensive subsidy for the government over time.

This rate was eliminated last month (January 1, 2026), however there are conflicting press reports indicating that it would still be available for wheat and medicine.

Data quality: Collected from Iranian press. Medium-high confidence on the rate; lower confidence on actual enforcement and availability. I could not find reliable sourcing to show how and if Iranian importers got access to this rate.

NIMA Rate (blue line)

The Iranian government launched NIMA (the Integrated Foreign Exchange Market System) in April 2018. NIMA was a foreign exchange platform that required Iranian exporters to repatriate and sell a percentage of their foreign currency earnings to the Central Bank, which then sold the hard currency to importers of essential goods at a subsidized rate well below the black market rate.

NIMA began its phase-out in December 2024 and was eliminated in January 2025.

Data quality: I was only able to find some of this data on TGJU (an Iranian financial information platform) and even then the data starts November 2018 — missing NIMA’s critical first seven months. Massive gaps from 2019-2023. After February 2022, it’s unclear if “NIMA” data is actually NIMA, ETS, or some unholy mixture of both. I have low confidence in these numbers because there are too many gaps for meaningful analysis. I’m including it because it’s all that exists, but any 2019-2023 analysis is speculative.

Electronic Trading System Rate (purple line)

Created in February 2022, ETS was intended to provide a formal platform for cash currency exchanges and was theoretically more market-driven than NIMA, with the CBI announcing that exchange rates would be “determined based solely on market supply and demand.” After the government axed NIMA in late 2024, ETS became the primary legal commercial channel for non-subsidized access to hard currency.

Data quality: Low-to-medium. ETS and NIMA overlapped for 34 months. No source differentiates them during this period — TGJU’s data could be NIMA, ETS, or some blend. Not sure what the data represents during overlap, more reliable post-December 2024 but still intermittent.

Unified Rate (yellow blip)

If you look closely, there is a yellow blip at the top right. In early January, the Iranian government tried to stem the eruption in the black market rate with a unified official rate at 1,310,000 rials — only 4.6% below the black market (~1.37M). In 2018, the CBI had been overly optimistic setting the official rate at 42,000. This time around they tried a dose of realism, but still got their face ripped off by the black market rate. Within three weeks, the black market premium widened from 4.6% to 22% (1.59–1.61M).

So, it sure feels like this attempt has already failed.

Data quality: Confirmed by Al-Akhbar and Iranian press. Low-to-medium confidence on announcement. I found multiple sources regarding the decision to eliminate the subsidized rate and move to a single rate, but I could not find a source to corroborate the 1.31 million rials from the Al-Akhbar article; premium calculation based on Bonbast data.1

Iran to read this!

Impressive data reconstruction given Iran's opacity. The subsidized import rate elimination creating an instant 75-80% price spike really explains the protest timing better than most coverage I've seen. Also intresting how the 'realist' unified rate at 1.31M still got blown up by the black market within weeks, basically proving you cant mandate currency stability without reserves.